Irs Schedule B 2024 Line – “Interest on a home equity loan is tax deductible if the money is used on renovations that substantially improve the home,” says Banfield. So, if you use the money you borrow with a home equity loan . The best tax software can help you file your federal and state tax returns easily and without having to shell out big bucks. In fact, many online tax prep tools featured on this list are free for .

Irs Schedule B 2024 Line

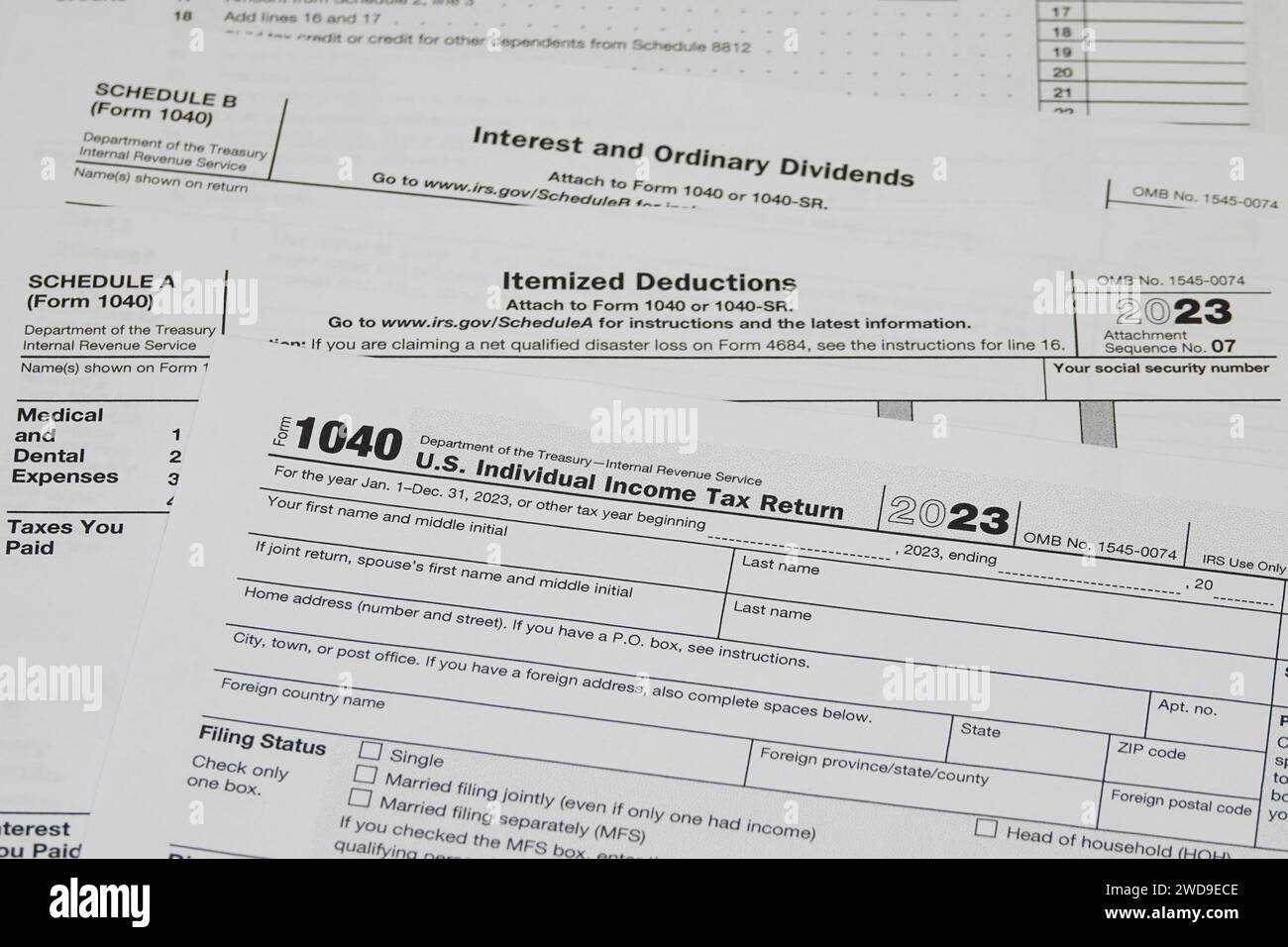

Source : www.ocrolus.comItemized deductions hi res stock photography and images Alamy

Source : www.alamy.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

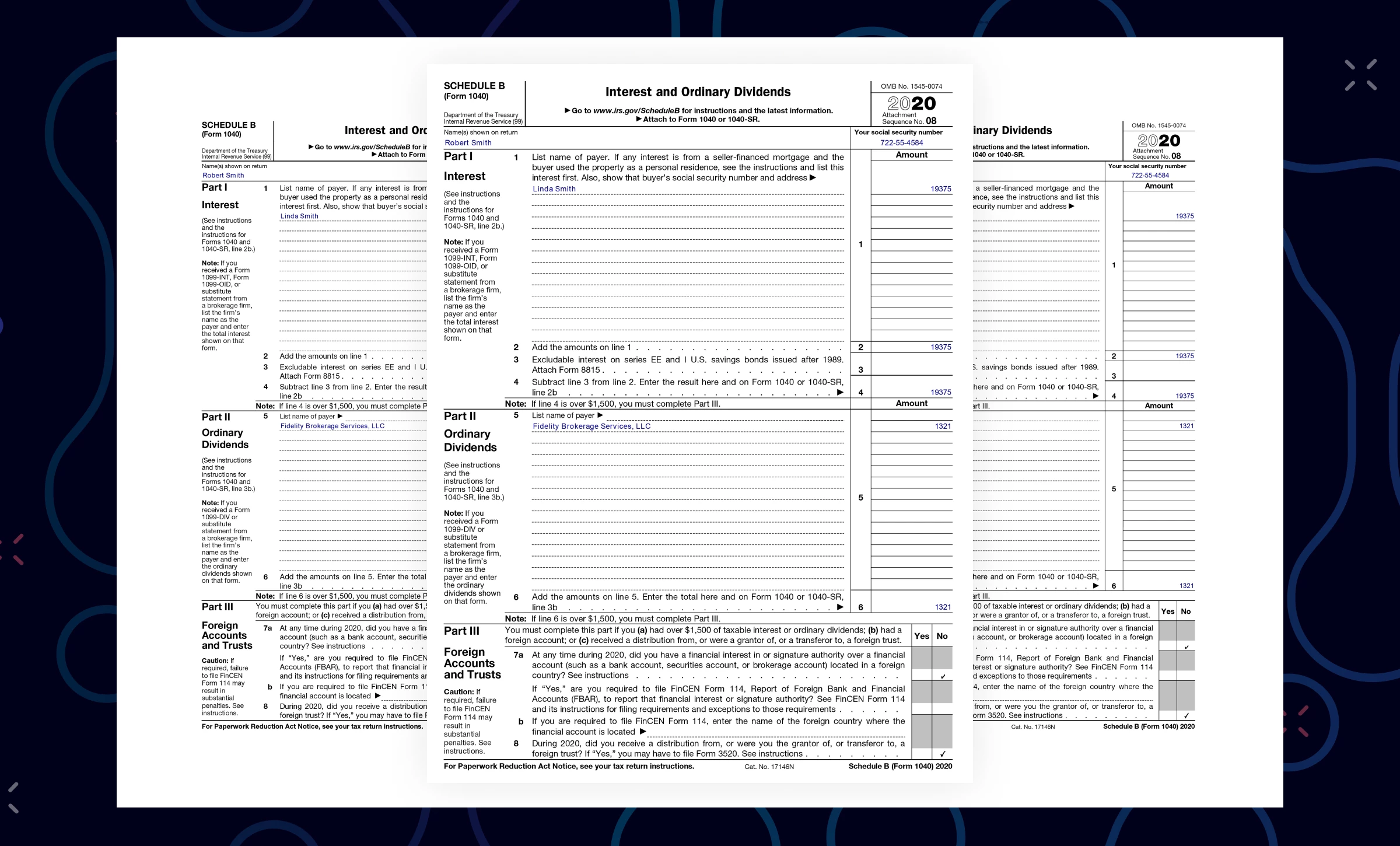

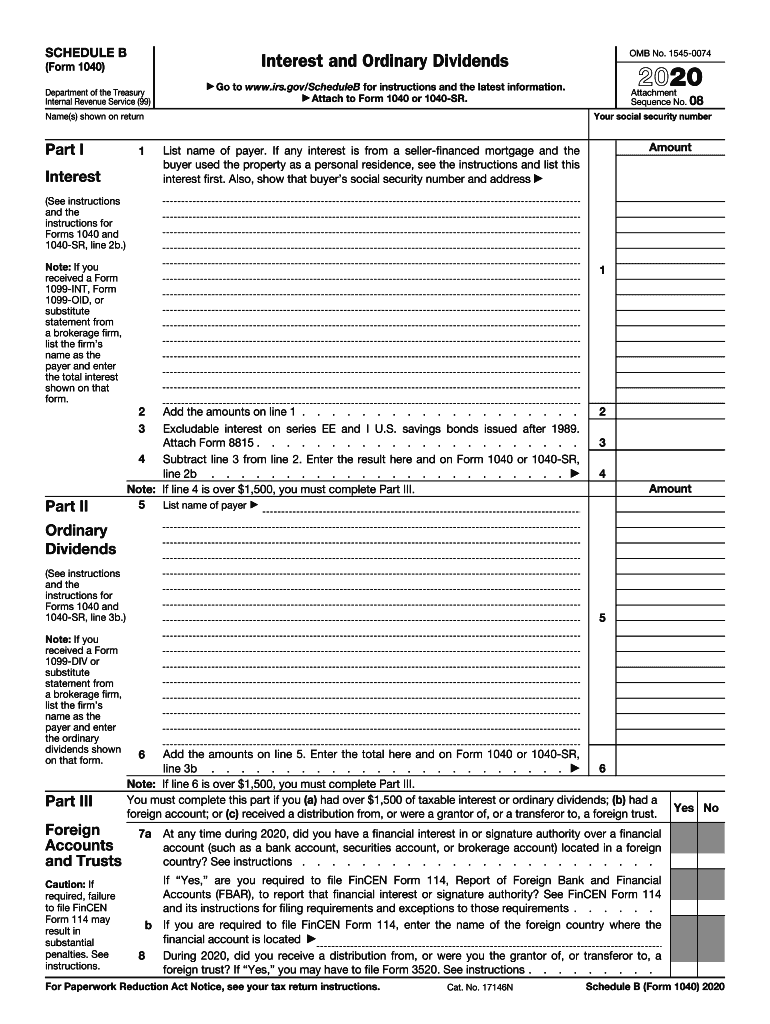

Source : www.bscnursing2022.comSchedule b: Fill out & sign online | DocHub

1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com2024 Tax Update and What to Expect

Source : sourceadvisors.comIrs Schedule B 2024 Line IRS Form 1040 Schedule B 2020 Document Processing: If you’re approved, you could get access to your credit line as soon as the same day Required paperwork likely includes business licenses, tax returns and financial statements. . (early 2024). A copy of this form will also be sent to the IRS. In most cases, homeowners can report the amount on this form on line 8a of Schedule A (Form 1040). However, the allowable deduction .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)