1040 Schedule A 2024 Line – Tax season has started for 2024. Find out when you need to file your taxes with the IRS and your state, and when you can expect your refund. . which you should receive from your lender in early 2024. You can then enter the amount from Line 1 on that Form 1098 into Line 8 of 1040 Schedule A. You can buy mortgage points, also called .

1040 Schedule A 2024 Line

Source : thecollegeinvestor.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

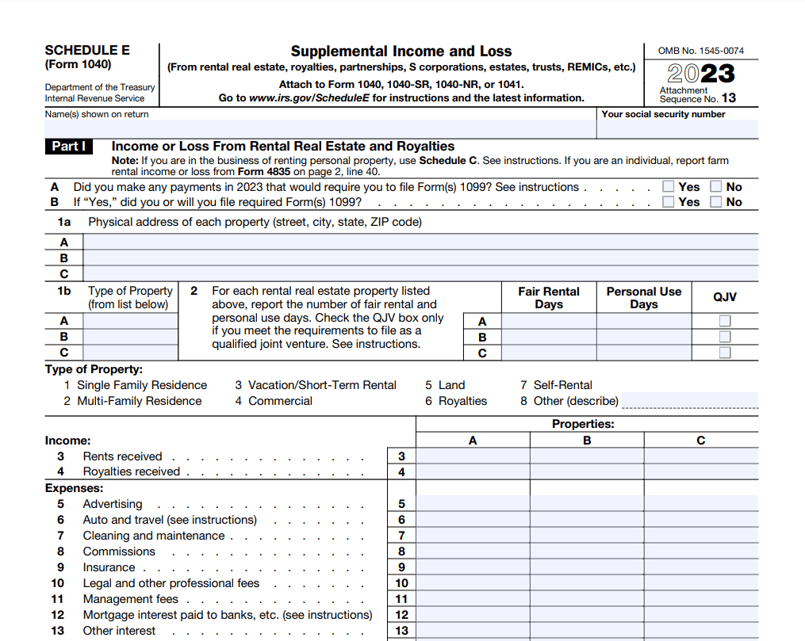

The 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comTax Due Dates For 2024 (Including Estimated Taxes)

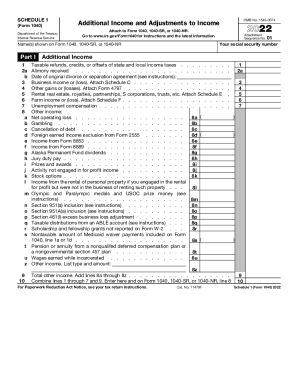

Source : thecollegeinvestor.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comU.S. Individual Income Tax Return Income

Source : www.irs.gov1040 Schedule A 2024 Line When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: “Interest on a home equity loan is tax deductible if the money is used on renovations that substantially improve the home,” says Banfield. So, if you use the money you borrow with a home equity loan . The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)